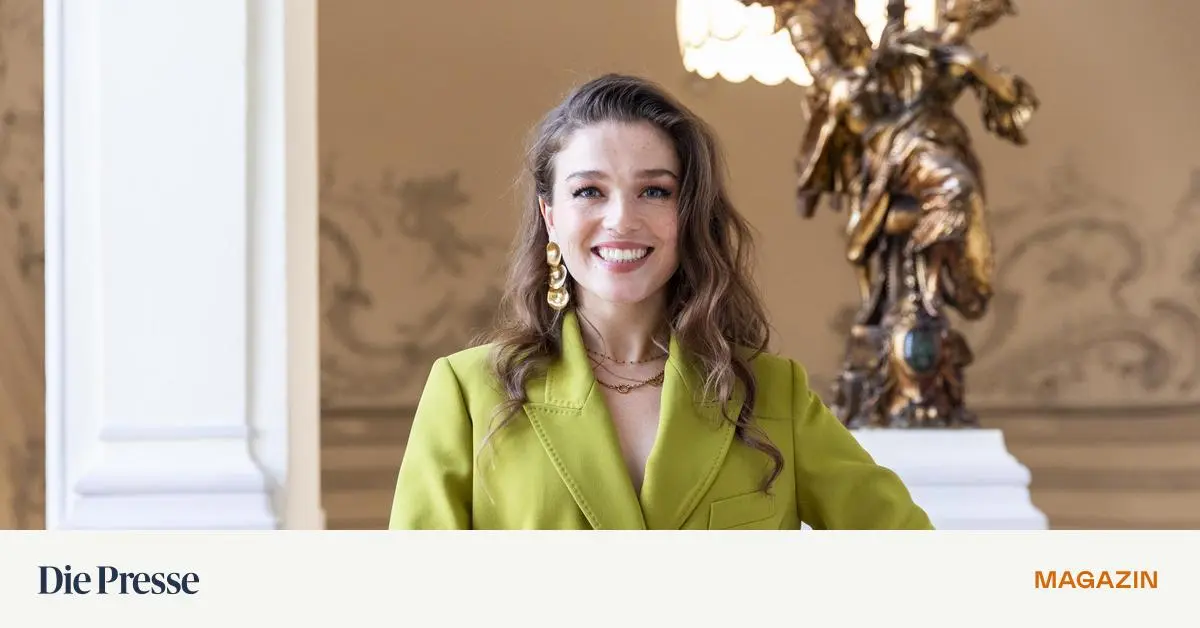

“Nienke Latten ist die neue Musical-Kaiserin von Wien – DiePresse.com”

Mit dem Musical „Maria Theresia“ wollen die Vereinigten Bühnen an die Erfolge von „Elisabeth“ und „Rock Me Amadeus“ anknüpfen. Für den niederländischen Musicalstar Nienke Latten in der Hauptrolle ist es eine Rückkehr nach Wien. Wobei sie sich mit der Bedeutung der Kaiserin für Österreich erst auseinandersetzen musste.

Es ist das nächste große Projekt der Musicalsparte der Vereinigten Bühnen Wien: „Maria Theresia“, das Musical, feiert im Oktober 2025 Premiere. „Rock Me Amadeus“ – ebenfalls eine Welturaufführung und mit einer Auslastung von quick 100 Prozent ein großer Erfolg – wird damit im Wiener Ronacher abgelöst. Und am Dienstag gewährte Intendant Christian Struppeck dort erstmals Einblicke in das Stück und die Besetzung.

Man wagt sich zwar nicht unbedingt an einen Nischenstoff – mit kaiserlichen Frauenfiguren haben die VBW ja schon Erfahrung und auch Movie und Fernsehen haben das Leben Maria Theresias schon mehrfach als Inspiration genommen –, aber musikalisch geht man durchaus neue Wege. Die Melodien von Sylvester Levay („Elisabeth“, „Rebecca“) haben Musical-Wien lang geprägt. Auch wenn das Orchester bei „Maria Theresia“ eine große Rolle spielen wird: Musikalisch dürfte der Schritt ein wenig mehr in Richtung Pop gehen.

Have any questions or want help? Contact us here. For extra insights, go to our website.

Learn More…